Roaming and Core Network

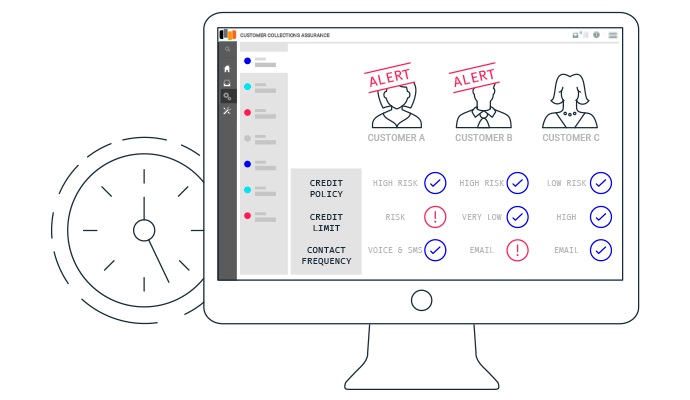

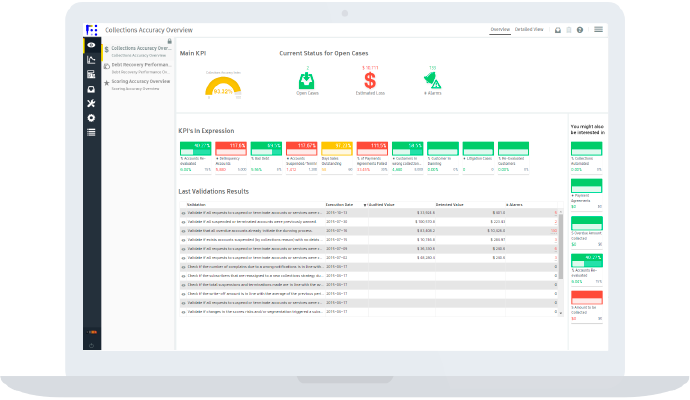

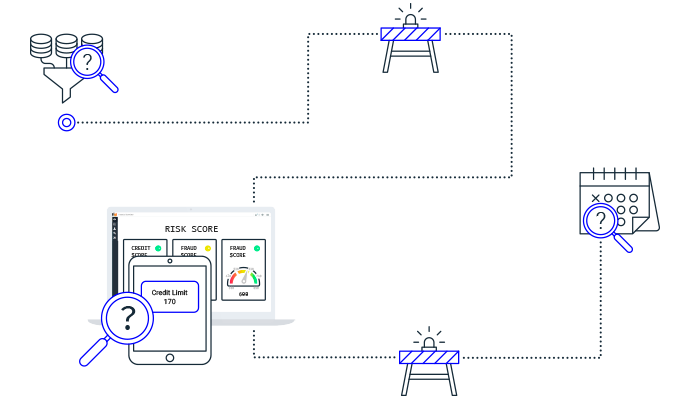

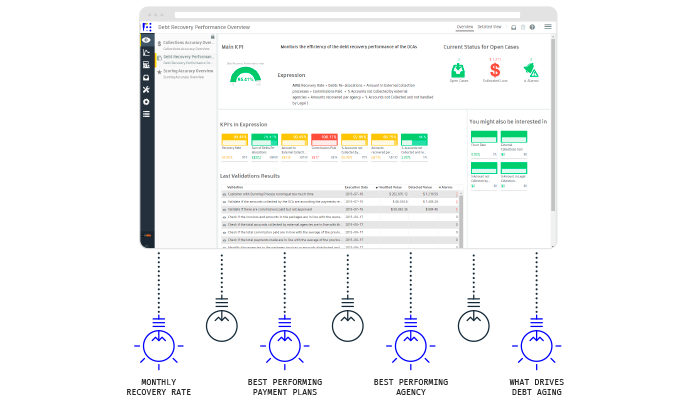

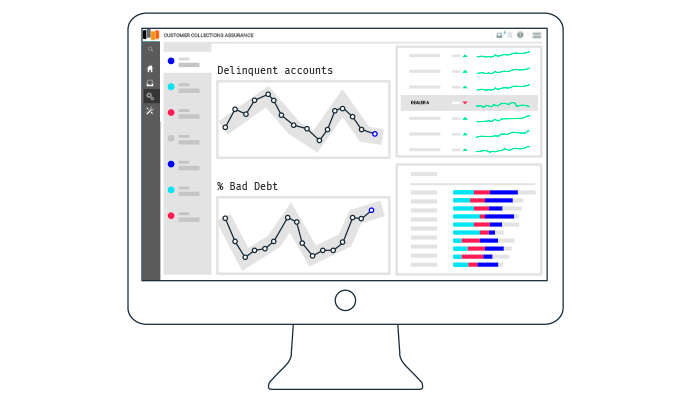

Risk Management

-

Revenue Assurance

- Usage Assurance

- Provisioning Assurance

- Rating & Billing Validation

- Prepaid Balance Validation

-

Fraud Management

- Revenue Share Fraud

- Bypass Fraud

- Roaming Fraud

- CLI Spoofing & Robocalling

- VoIP & SIP Fraud

- Dealers Fraud

- Subscription Fraud

- Data Fraud

- Telecom Wholesale Fraud

- SMS Bypass Fraud

Network Security

Testing and Monitoring

-

Domestic Network Testing

- SITE Platform

- 5G SA & NSA Performance Testing

- Core Network Testing

- Automation Framework

- RoboShark Automated PCAP Analysis

- Smartphone-based Testing

- Emergency Services Testing

- Video Performance Testing

- IoT & eSIM Performance Testing

- IMS and VoLTE Testing

- CS Voice, Data & Messaging Testing

- Mobile Money Testing

-

International Network Testing

- 5G Roaming Quality Assurance

- Roaming Quality Testing

- VoLTE Roaming Testing

- eSIM Macroscope

- Performance Intelligence

- Global IoT Connectivity Testing

- Roaming QoE at Large-Scale Events

5G

Internet of Things (IoT)

Service & Network Assurance

Check our Services

Check out our exclusive insightful content